B

Bridging Loan

A loan to “bridge the gap” between the sale of your present property and the purchase of your new home, when the dates don’t coincide (or until long term finance comes through from your mortgage lender).

Buildmark

Your newly-built Qudos home is covered by the Buildmark 10 Year structural warranty and insurance cover.

C

Completion

The finalising of the sale when all the monies are passed over and the buyer has legal right to the property.

Contract

Entered into by the seller and buyer of a property which only becomes binding on exchange of contracts, i.e. when both parties have signed the contract and the purchaser has handed over the agreed deposit to the solicitor.

Conveyancing

The legal transfer of a property from one owner to another.

Covenant

A restriction or condition affecting the property, which must be complied with.

D

Deeds

All the legal documents relating to the property.

Deposit

A part payment of the agreed purchase price paid by the buyer on exchange of contracts (or conclusion of missives in Scotland).

Disposition or Feu Disposition (Scotland only)

A legal document which transfers ownership of a property to the buyer.

E

Energy Performance Certificate

The sellers of properties in England and Wales are required to provide a valid Energy Performance Certificate (EPC). It gives details about the energy efficiency of the property.

Exchange of Contracts

The contracts are in fact two identical documents, one signed by the seller and the other by the purchaser. When these are exchanged, both sides are legally bound to complete the transaction.

F

Freehold

The full ownership of both the property and the land on which it stands.

G

Ground Rent

This applies to Leasehold properties and is a sum paid annually to the Freeholder by the Leaseholder.

I

Insurance

This is usually discussed with your mortgage adviser or lender when making mortgage arrangements.

You will need:

-

Contents insurance:

To work out how much cover you need for a household contents insurance policy, you need to add up the value of all the possessions in your home. It is recommended that any items of particular value – jewellery for example – are specified and covered by an “all risks” policy, which applies even when the items are not in the home.

-

Buildings Insurance:

Cover for the bricks and mortar of your home. It is advisable to review insurance cover regularly.

L

Land Certificate

A certificate issued by the Land Registry as proof of ownership.

Land Registry Fees

These are paid through your solicitor to register your ownership of the property with the Land Registry. The scale of fees is fixed by the Government.

Leasehold

Land held under a lease for a number of years, on which ground rent is paid.

Local Authority Search

Carried out by your solicitor, this establishes if your new home is likely to be affected by any planning decisions.

M

Management Company

Apartment buildings usually have a management company responsible for maintaining the main structure, common parts (e.g. stairs and hallways) and landscaped areas. On some developments a management company may also maintain roads, street lighting and open spaces. The management company recovers its costs from each owner through a service charge.

Missives (Scotland Only)

The name given to a contract. Missives are letters exchanged by the purchaser (making an offer for the property) and the seller (accepting the offer).

Mortgage

Most people will need to take out a mortgage – or loan – to buy a house. There are many different types of mortgages available to home buyers – your mortgage adviser will explain.

Mortgagee

The lender.

Mortgagor

The borrower (whose property is secured for the loan).

Mortgage Indemnity Insurance / Guarantee

Your mortgage lender will usually require additional security if the loan is in excess of 70% or 80% of the purchase price. This involves a once-only payment which can normally be added to your mortgage. The amount of the payment varies with the amount borrowed and the term of the loan.

Mortgage Protection Policy

An insurance policy often arranged in conjunction with a repayment mortgage, which is taken out to ensure that the loan will be paid off should the borrower die before the end of the mortgage term. Insurance may also be available to protect your repayments in the event of redundancy.

Mortgage Valuation Survey

Prior to making a mortgage offer your lender will have the property valued for “mortgage purposes”. You will pay a fee (variable on the purchase price of the property).

R

Registered Land

Land (including buildings on it) the title to which is registered at the Land Registry and legal ownership of which is guaranteed.

S

Searches

A term used to denote the physical and written procedure for determining any adverse effects in/on a particular property, whether already in effect or planned to take place.

Settlement (Scotland Only)

The end of the house buying process, when the deeds of the new house and other documents are handed over, in return for the agreed price.

Stamp Duty

Government tax on the purchase price of a property. Your solicitor will automatically handle this.

Sold Subject To Contract

Sold ‘Subject to Contract’ (STC) means that the seller and buyer are proceeding with the sale but the paperwork is not yet complete.

The rights and liabilities that attach to the property.

T

Title Deeds

Legal documents describing the rights and liabilities that attach to the property and prove ownership of property.

Title Report On

Solicitors’ certificate confirming that the title to the property is acceptable. A Lender must have one before an advance cheque for the mortgage monies can be issued.

W

Will

A Will is a legal document that allows a person to make decisions on how his or her estate will be managed and distributed after his or her death. As a homeowner, it is advisable to make a will – or alter an existing one. Your solicitor can advise you.

Our Developments

Blue Bell Court, Barton

Blue Bell Court is an exclusive charming new development located close to the town centre of North Lincolnshire’s historic market town, Barton upon Humber.

Francis Gardens, Scawby

Eighteen magnificent family homes in the heart of one of the most popular North Lincolnshire villages, Scawby.

Raising The Roof of Expectations

‘The quality of the design and materials used set Qudos shoulders above any new home that we viewed’

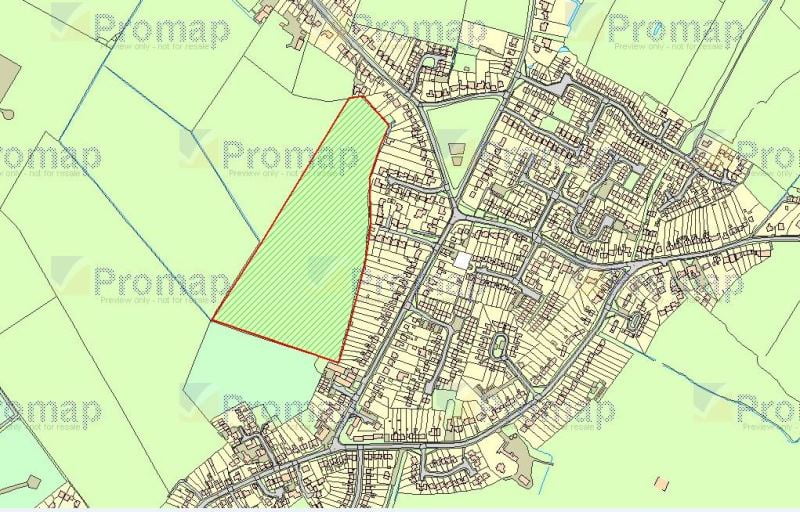

Do you have land that you would consider selling?

Qudos Homes are always looking for new land and / or property opportunities, whether greenfield or brownfield and with or without planning premission.